Financing the Change: ESG Investing and Climate Finance

Programme

Financing the Change: ESG Investing and Climate Finance

Programme Length

6 Days (3 modules, 2 days each)

Programme Fee

HK$49,800

Medium of Instruction

English

Delivery Approach

Face-to-face

PROGRAMME HIGHLIGHTS

- Build practical skills through role play and simulations such as mock trading in an emission trading system (ETS)

- Interact with prominent industry leaders and thought leaders through specially curated visits and talks

- Gain practical insights and perspectives from an interdisciplinary panel of experts

ABOUT THE PROGRAMME

In recent years, the frequent occurrence of extreme weather has brought about a series of catastrophic consequences. According to statistics from the United Nations Office for Disaster Risk Reduction (UNISDR), there were 389 large-scale natural disasters in 2020 causing economic losses of US$171.3 billion which exceeds the average level of 2000-2019. 90% of the devastating disasters and losses are caused by climate. The Bank for International Settlements refers to climate change-related risks as “green swan” risks and believes that it may trigger a systemic financial crisis.

At the same time, the action to respond to and adapt to climate change provides new investment opportunities for green transformation. China’s pledges to achieve CO2 emissions peak by 2030 and carbon neutrality by 2060 is expected to result in green investment opportunities worth tens of trillions of dollars. Demand for both the professionally managed portfolios that integrate key elements of ESG assessments and the ESG-related traded investment products available to institutional and retail investors will continue to grow.

This programme aims to prepare the participants for the opportunities and growth in ESG Investing and Climate Finance. Balancing the breadth and depth of the most relevant and timely issues in ESG investing and climate finance, the programme equips participants with essential and cutting-edge knowledge in include climate economics, carbon emission policies and carbon markets around the world, ESG reporting for both publicly listed corporations and asset managers, ESG data and ratings from major initiatives and data providers, green finance instruments such as green bonds and sustainability-linked bonds, and ESG integration including engagement by impact investors.

WHO SHOULD ATTEND

- Practitioners working in finance or investing who want to understand the economic, social and environmental dimensions of sustainability and their implications for investment decisions and asset management approaches;

- Senior business executives that are interested to learn the latest development in the financial markets;

- Anyone looking to extend their knowledge of ESG and prepare for professional certifications.

BENEFITS

- Stay up to date on trends, policies and identify pathways and opportunities in the process of achieving carbon neutrality

- Develop structured overview and insights on investment methods and decisions integrating ESG criteria

- Grasp the newest approaches and practices of sustainable investing and lending in international and China markets

A Certificate of Attendance will be presented to the participants who achieve at least 70% attendance.

PROGRAMME STRUCTURE

1

Driving Finance for Climate Resilience: Climate Economics and Carbon Markets

2 Days

2

Financing Sustainable Development: Financial Instruments and ESG Integration

2 Days

3

Measuring and Reporting ESG Performance: Data, Standards and Impact

2 Days

CONTENT OVERVIEW

| Module | Key Topics | Learning Objectives |

| Driving Finance for Climate Resilience: Climate Economics and Carbon Markets | • Climate economics, carbon emission data, and cost of carbon • Science and engineering aspect • Carbon market and carbon offsets • Measuring and taking action: Science-Based Target Initiative (SBTi), Paris-Aligned Benchmarks | • Understand climate change and its consequences • Learn how economics can help address the challenges of climate change • Analyse different types of environmental policies • Identify pathways and opportunities in the process of achieving carbon neutrality • Learn techniques and strategies on carbon reduction • Develop insights in carbon markets in EU, US, and China • Build practical skills on carbon trading |

| Financing Sustainable Development: Financial Instruments and ESG Integration | • Sustainable Finance Instruments: Green Bonds • Sustainable Finance Instruments: Sustainability-linked Bonds and others • Green Assets for Banks, Insurers, and Asset Managers • Government, Activists, International Collaborations, Green Taxonomy | • Learn the issuance and pricing of green bonds and loans • Learn other green finance instruments such as Social, Sustainable, Sustainability-linked Bonds and Loans • Familiarise with practical cases and prominent examples • Grasp global and Chinese practices such as carbon neutrality bonds • Develop practical skills in ESG integration including engagement by impact investors |

| Measuring and Reporting ESG Performance: Data, Standards and Impact | • ESG Reporting (TCFD, GRI, SASB, etc.) Disclosure Requirements • ESG Rating • ESG Investing • ESG integration for issuers and financiers | • Evaluate the global trend for ESG reporting including the TCFD (Task Force on Climate-related Financial Discloures) and climate risk disclosure for asset managers • Examine the international, regional and local standards related to ESG reporting in the capital markets • Develop holistic understanding of the collection and use of ESG data (including climate stress test for banks) as well as ESG ratings |

LEARNING EXPERIENCE

The programme adopts a wide range of pedagogical tools to maximise impact, ranging from carefully selected and curated reading, interactive discussions, case studies, simulations and group discussions. Such developmental experience aims to provide you with the opportunity to critically apply the various frameworks and tools to make a difference in your personal and professional life.

PRACTICAL INDUSTRY INSIGHTS

Built on the academic rigor and relevance, this programme combines site visits, panel discussions and leading industry speakers to provide participants with a real-world, hands-on experience.

FACULTY PROFILES

Prof. Dragon TANG

Professor

Academic & Professional Qualification

- Ph.D., University of Texas at Austin

- M.S., Texas A&M University

- B.S., Jilin University

Dr. Guojun HE

Associate Professor

Academic & Professional Qualification

- Ph.D., UC Berkeley

- B.A., Peking University

Prof. Yuk-fai FONG

Professor

Associate Dean (Taught Postgraduate)

Academic & Professional Qualification

- Ph.D., Boston University

- Master, Chinese University of Hong Kong (MPhil)

- Bachelor, Chinese University of Hong Kong (BSSc)

Dr. Wenlan QIAN

Associate Professor

Academic & Professional Qualification

- Ph.D., Finance and Real Estate, University of California, Berkeley, USA, 2008

- B.Econ, Economics, Shanghai International Studies University, China, China, 1998

Dr. Shipeng YAN

Assistant Professor

Academic & Professional Qualification

- Ph.D., Universidad de Navarra IESE Business School

- Bachelor, University of Hong Kong

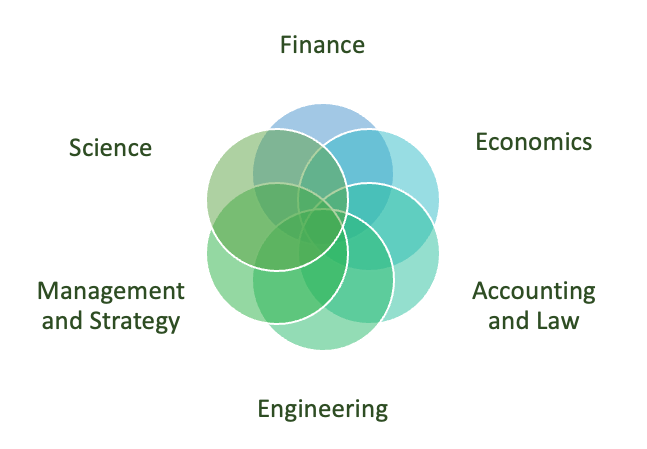

INTERDISCPLINARY FACULTY RESOURCES

Given the interdisciplinary nature of sustainable and green finance, the programme leverages on the robust ecosystem of the University of Hong Kong to offer holistic and broad-based learning experience. Leading experts and scientists across disciplines will be invited to share their insights in the programme.

SCHEDULE AND VENUE

Date:

| Module 1 | Driving Finance for Climate Resilience: Climate Economics and Carbon Markets | Date to be confirmed |

| Module 2 | Financing Sustainable Development: Financial Instruments and ESG Integration | Date to be confirmed |

| Module 3 | Measuring and Reporting ESG Performance: Data, Standards and Impact | Date to be confirmed |

Venue:

HKU Business School

K.K. Leung Building

The University of Hong Kong

Pokfulam Road

Hong Kong

FEES AND FUNDING

Full programme fee:

HK$49,800 per participant

CONTACT

Mr. Adrian CHAN

Phone: 3962 1230

Email: adcwc@hku.hk